The landscape of cryptocurrency mining is continuously evolving, creating a vibrant tapestry woven with the threads of technological advancement, market demand, and economic pressures. At the forefront of this transformation lies Litecoin—an altcoin that has captured the attention of miners and investors alike. As we delve deeper into the hidden factors influencing the prices of Litecoin mining devices today, we uncover a myriad of influences that shape this dynamic market.

To begin understanding the intricacies of Litecoin mining device prices, it’s imperative to appreciate the volatile nature of the cryptocurrency market. The value of Litecoin, much like its more famed counterpart Bitcoin, experiences dramatic peaks and troughs. These fluctuations can result from regulatory news, technological breakthroughs, or market sentiment shifts. Consequently, as the demand for Litecoin surges, so too does the interest in mining devices specifically engineered for optimal performance. Miners often seek out machines with exceptional hash rates and energy efficiency, amplifying the price for these coveted rigs.

The competition between cryptocurrencies also significantly impacts device pricing. Take, for instance, the interplay between Litecoin and Bitcoin. As the leading cryptocurrency, Bitcoin often overshadows other coins, including Litecoin. However, when Bitcoin’s mining difficulty escalates, many miners pivot their focus to Litecoin, boosting the demand for Litecoin mining devices. The increase in demand invariably leads to higher prices, making market trends a crucial aspect of any miner’s strategy.

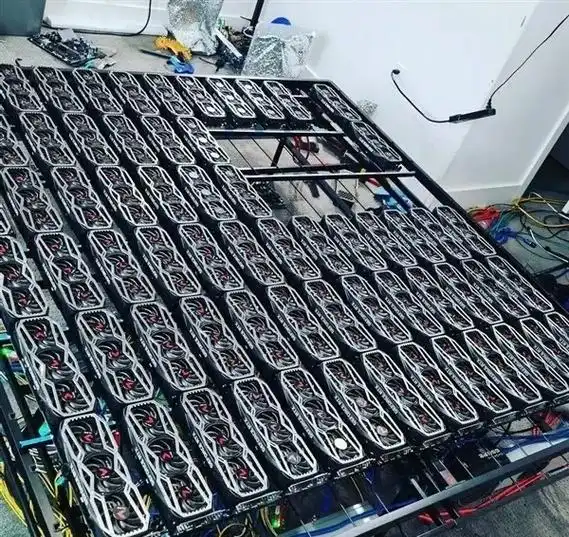

Moreover, the design and engineering of Litecoin-specific mining devices play a pivotal role in dictating their prices. Mining rigs that leverage the latest technology—such as ASIC (Application-Specific Integrated Circuit) miners—often carry a heftier price tag. These state-of-the-art devices maximize hash power while minimizing energy consumption, setting a new standard in the mining community. Conversely, older equipment lacking efficiency tends to depreciate in value as miners aim for higher profitability and lower operational costs.

Another layer of complexity stems from mining farms and their hosting services. Many miners choose to host their devices in specialized facilities designed for optimal performance and security. These hosting solutions often come equipped with advanced cooling systems, robust internet connectivity, and reliable power supply, all of which contribute to a more stable mining operation. The cost of these services is reflected in the overall price of the mining devices, making it essential for miners to weigh hosting costs against projected mining returns.

Regulatory scrutiny is another undercurrent affecting the prices and availability of Litecoin mining devices. Regions that impose stringent laws or high taxes on cryptocurrency mining can create an air of uncertainty among potential miners. In such environments, mining operations may become less viable, leading to surplus equipment in the market, which can lower prices temporarily. Conversely, favorable regulations can stimulate demand, driving prices higher as new entrants flock to mining opportunities.

The role of exchanges in the cryptocurrency ecosystem cannot be overlooked. The availability of Litecoin trading on prominent exchanges often dictates its popularity and, by extension, the interest in its mining equipment. Increased trading volume tends to galvanize new investment in mining operations, thereby inflating demand for Litecoin mining hardware. Furthermore, a thriving community around Litecoin can encourage the development of innovative mining technologies, further impacting equipment prices.

Understanding the interplay of supply and demand is crucial for any miner. As the number of miners increases, the competition for rewards becomes fiercer, often leading to the need for more sophisticated—and pricier—mining rigs. Additionally, as Litecoin’s halving events approach, miners may scramble to acquire the latest hardware, contributing to sharp fluctuations in device prices. These market dynamics represent an intricate ballet of opportunity and risk, where timing can be everything.

In conclusion, the prices of Litecoin mining devices are influenced by a multitude of hidden factors ranging from technological advancements and market dynamics to regulatory developments. For miners, navigating this landscape requires a keen understanding of how these elements interact and affect profitability. Whether it’s investing in the latest ASIC rigs, choosing a reliable hosting solution, or staying abreast of market trends, informed decision-making can significantly enhance one’s mining success in this rapidly changing environment.